I4H conducted analysis on average rent and evictions based on the Statistical Data Return for 2016/17. The Statistical Data Return (SDR) is an annual survey completed by all English PRPs (Private Registered Providers). It collects data on stock size, location and types, PRP characteristics, rents and activities over the year.

We found the following key findings ;

• RPs with predominantly HfOP stock have a higher cost per unit and significantly reduced operating margin.

• The levels of debt for higher HfOP stock is lower and liquidity better, indicative of lower levels of development of this type of stock.

• The average rent for all social registered landlords based on 1490 organisations is £101.42 per week. We have analysed general needs units only for this analysis.

• The average rent loss per eviction is £4,361.

• The average number of evictions (ASB, rent arrears and other evictions) for the same number of organisations is 36 per provider.

• So, for all landlords the total rent loss due to evictions based on 43-week eviction average is £156,996 based on an average of 36 evictions per landlord.

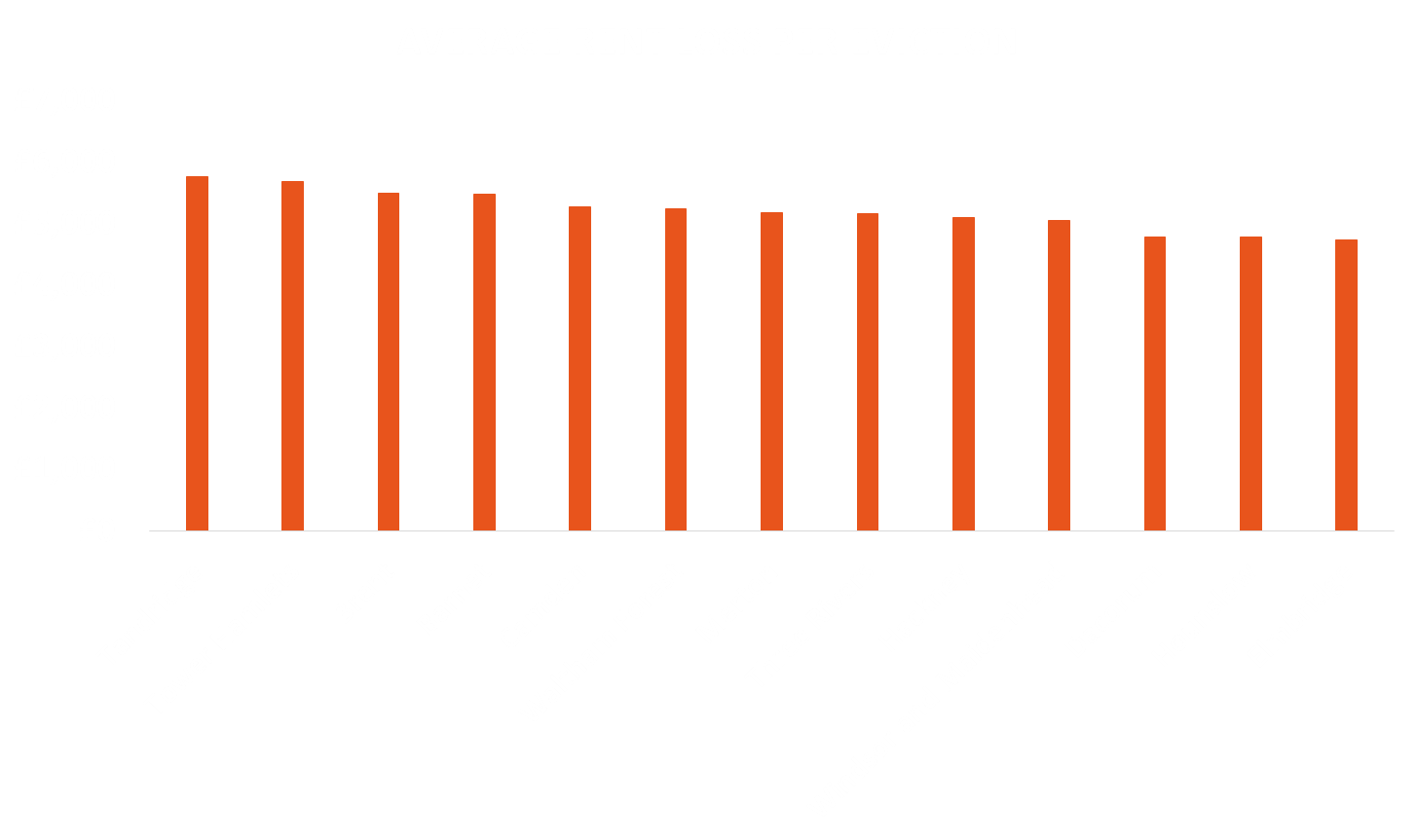

• There will of course be regional variances based on the average rent and average number of evictions. The chart below shows the highest 10% cost per eviction based per local authority area. The chart shows the average number of evictions per LA area, average rent per LA and using the average 43 weeks eviction time.

• In conclusion there are significant savings to be made if the 43-week period can be reduced. As expected southern landlords are at a particular disadvantage as shown below due to the higher rents and London Boroughs with higher eviction rates.

Leave a Reply